23rd October 2023

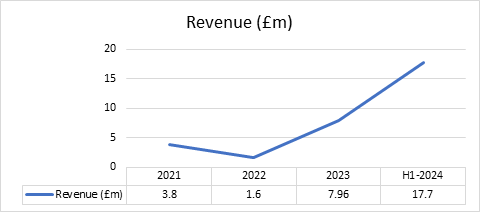

Crossflow, the global working capital marketplace today announces H1 results with revenue of £17.7m for the period April-September 2023.

This is a significant increase on £7.96m achieved in FY 2023 and is indicative of the focus of the business on funding the supply chains of large corporates with revenues greater than £1Bn.

FY Projection

This puts the business on track for revenue of FY £40m.

Growth Drivers

-

Corporate Bond Costs- As corporates face increasing costs to refinance bonds, SCF is being utilised as an alternative to bonds as a means to generate working capital through payment terms extensions.

-

Competitive funding costs to suppliers- Crossflow’s AI driven working capital platform enables suppliers to access working capital at a lower cost mitigating the impact of payment terms extensions.

-

Increase in funding capacity- Financial institutions are increasing funding capacity through Crossflow as they are achieving higher net yields then they could otherwise achieve through their existing services, due to the low operational cost of funding through the Crossflow working capital marketplace.

About Crossflow Payments

Crossflow is an AI driven working capital marketplace helping global businesses and their suppliers to seamlessly connect with institutional funders enabling access to global pools of working capital. This access to capital strengthens corporate supply chains, reducing risk and in parallel enables delivery of ESG investment.

Crossflow works with international banks, hedge funds and family offices to provide access to sources of diversified funding.

Crossflow is ranked No 1 B2B Fintech in the Financial Times' list of 1,000 fastest growing company in Europe and is also a member of the London Stock Exchange ELITE Program which helps companies to structure corporate governance at an early stage as a key path to an IPO.

Are you looking to implement and strengthen your financial result and supply chain with technology driven solution?

Learn how to implement a sustainability strategy in partnership with your suppliers.

Contact Us